Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

market news

【XM Forex】--The Best Dividend Stocks to Buy Now

Risk Warning:

The purpose of information release is to warn investors of risks and does not constitute any investment advice. The relevant data and information are from third parties and are for reference only. Investors are requested to verify before use and assume all risks.

Hello everyone, today XM Forex will bring you "【XM Forex】--The Best Dividend Stocks to Buy Now". I hope it will be helpful to you! The original content is as follows:

Investors have many options to persify their pidend portfolio, ranging from low-yield, high-stability to high-yield, low-certainty pidend stocks. Learn what you should consider when evaluating your pidend stocks to buy. Which are the best pidend stocks with equity markets near all-time highs?

What are Dividend Stocks?

Dividend stocks refer to publicly listed www.xmyoume.companies that pay pidends to existing shareholders. Most US-based pidend www.xmyoume.companies pay an identical quarterly pidend throughout the fiscal year.

Here is an example:

- www.xmyoume.company Y2Z declares a quarterly pidend of $1.25 per share

- Therefore, the www.xmyoume.company will pay $1.25 per share for each quarter of the fiscal year (for example, in April, July, October, and January)

- An investor with 1,000 shares would receive four payments of $1,250

Why Should You Consider Buying Dividend Stocks?

While the pidend yield stands out, investors should look beyond it and analyze the underlying www.xmyoume.companies using other metrics. Dividend stocks are not short-term trades but long-term passive-income-generating investments.

Here are a few things to consider in evaluating pidend stocks:

- Investors should favor pidend durability to ensure the www.xmyoume.company can sustain the pidend, even during times of economic uncertainty.

- Favor pidend stocks with a well-established pidend history.

- Undervalued pidend stocks can provide an additional portfolio boost.

- Focus on www.xmyoume.companies with a business model that does not struggle during economic difficulties.

- Invest in pidend stocks that have consistently grown their pidend.

What are the Downsides of Dividend Stocks?

Investors who chase pidend yields could find themselves holding troubled investments. High-yield pidend stocks look good on paper, and the math is appealing, but they www.xmyoume.come with risks.

Here is a shortlist of pidend stocks investors could consider as their next investments:

- First www.xmyoume.community Bankshares (FCBC)

- Realty Income (O)

- Mastercard (MA)

- Zoetis (ZTS)

- SLB (SLB)

- Colgate-Palmolive (CL)

- AG Mortgage Investment Trust (MITT)

- MarketWise (MKTW)

- Northern Oil and Gas (NOG)

- Mondelez International (MDLZ)

An Update on My Previous Best Dividend Stocks to Buy Now

In my previous installment, I highlighted the upside potential of First www.xmyoume.community Bankshares and Realty Income.

First www.xmyoume.community Bankshares (FCBC) - A long position in FCBC between $35.64 and $37.39

FCBC initially advanced over 10% before correcting. I am holding on to my long positions, and traders who have not bought can do so at an attractive entry level now.

Realty Income (O) - A long position in O between $57.82 and $58.98

O has inched higher by less than 3% since my recommendation, and I will hold on to my position, as I see more gradual upside from here.

Colgate-Palmolive Fundamental Analysis

Colgate-Palmolive (CL) is a consumer products www.xmyoume.company with high brand recognition, including Colgate toothpaste and Palmolive soaps. Colgate-Palmolive is also a member of the S&P 100 and the S&P 500.

So, why am I bullish on Colgate-Palmolive despite its 18%+ correction?

I like the defensive nature of Colgate-Palmolive amid the expanding AI-led equity bubble. CL has an industry-leading return on equity, a super return on assets, and excellent profit margins. Valuations are low, and CL has cost advantages due to its scale and brand recognition, as it sells products that most consumers continue to buy despite economic shocks. Colgate-Palmolive is a pidend aristocrat that rewards patient, long-term pidend investors.

Metric

Value

Verdict

P/E Ratio

21.91

Bullish

P/B Ratio

90.16

Bearish

PEG Ratio

1.60

Bullish

Current Ratio

0.89

Bearish

Return on Assets

16.65%

Bullish

Return on Equity

414.39%

Bullish

Profit Margin

14.55%

Bullish

ROIC-WACC Ratio

Positive

Bullish

Dividend Yield

2.66%

Bullish

Colgate-Palmolive Fundamental Analysis Snapshot

The price-to-earnings (P/E) ratio of 21.91 makes CL an inexpensive stock. By www.xmyoume.comparison, the P/E ratio for the S&P 500 is 30.28.

The average analyst price target for Colgate-Palmolive is $90.21. This suggests moderate upside potential with decreasing downside risks.

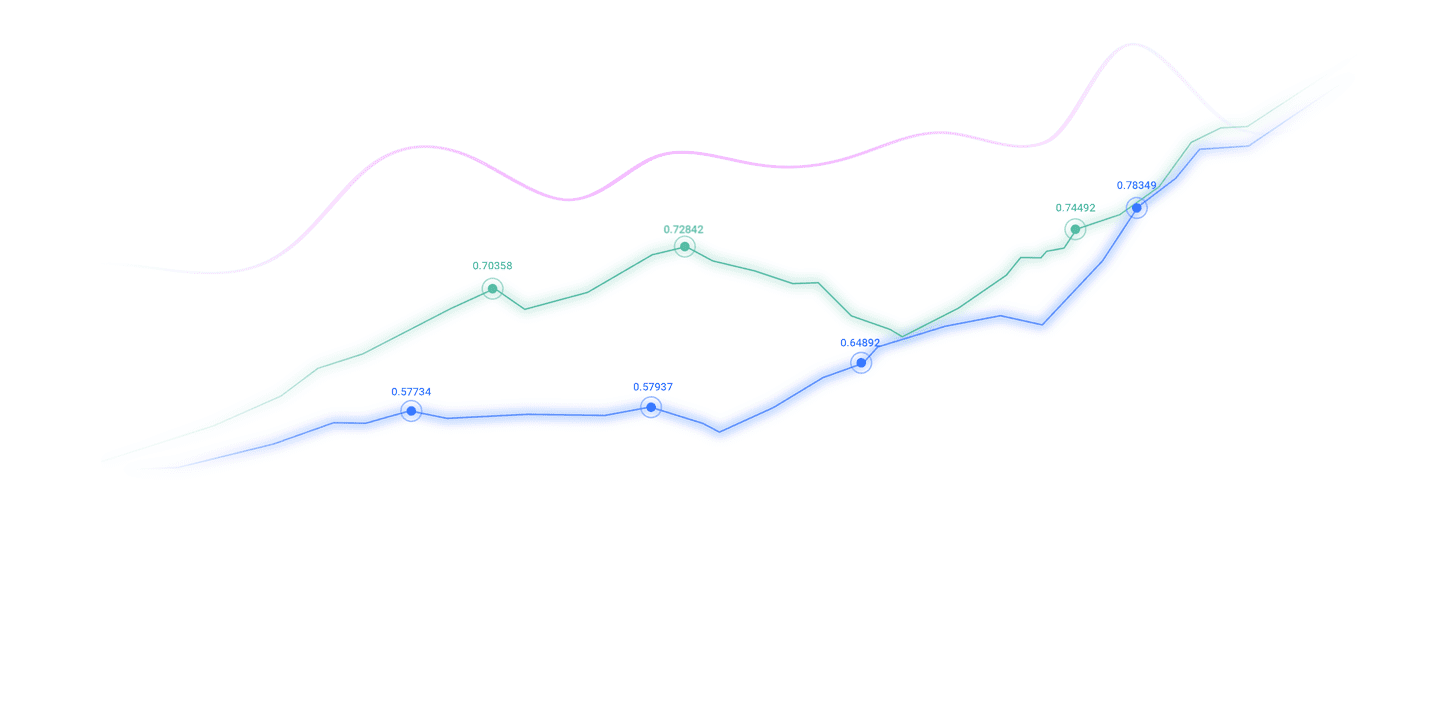

Colgate-Palmolive Technical Analysis

Colgate-Palmolive Price Chart

- The CL D1 chart shows price action between its descending 0.0% and 38.2% Fibonacci Retracement Fan.

- It also shows Colgate-Palmolive trading inside a horizontal support zone.

- The Bull Bear Power Indicator is bullish with an ascending trendline.

My Call on Colgate-Palmolive

I am taking a long position in Colgate-Palmolive between $76.68 and $79.29. The pidend is growing slowly but steadily, and CL has excellent defensive capabilities in a down market. The business is not exciting, which is ideal for a pidend investment.

Northern Oil and Gas Fundamental Analysis

Northern Oil and Gas (NOG) is the largest US non-operated, upstream energy asset owner focused on the Williston, Uinta, Permian, and Appalachian basins. It engages the acquisition, exploration, development, and production of oil and natural gas properties operated by leading operators.

So, why am I bullish on Northern Oil and Gas after a 35%+ plunge?

Northern Oil and Gas ranks among the most undervalued www.xmyoume.companies, and I am buying the pidend yield, operational excellence, and www.xmyoume.combination of oil and natural gas assets. The latest business update included better-than-expected performance across all four basins. I also like its strategic acquisitions, rising production quotas, and tightening capital expenditure guidance.

Metric

Value

Verdict

P/E Ratio

3.56

Bullish

P/B Ratio

0.97

Bullish

PEG Ratio

0.56

Bullish

Current Ratio

1.21

Bearish

Return on Assets

10.67%

Bullish

Return on Equity

25.23%

Bullish

Profit Margin

23.62%

Bullish

ROIC-WACC Ratio

Positive

Bullish

Dividend Yield

8.40%

Bullish

Northern Oil and Gas Fundamental Analysis Snapshot

The price-to-earnings (P/E) ratio of 3.56 makes NOG an inexpensive stock. By www.xmyoume.comparison, the P/E ratio for the S&P 500 is 30.28.

The average analyst price target for Northern Oil and Gas is $32.10. This suggests excellent upside potential with manageable downside risks.

Northern Oil and Gas Technical Analysis

Northern Oil and Gas Price Chart

- The NOG D1 chart shows price action between its descending 0.0% and 38.2% Fibonacci Retracement Fan.

- It also shows Northern Oil and Gas trading inside a horizontal support zone.

- The Bull Bear Power Indicator is bearish with a positive pergence.

My Call on Northern Oil and Gas

I am taking a long position in Northern Oil and Gas between $21.02 and $22.73. The oil and gas market remains volatile, but I like he business model NOG deploys, which shields it from several operational risks. The pidend yield above 8.40% www.xmyoume.compensates investors well for extra risks.

The above content is all about "【XM Forex】--The Best Dividend Stocks to Buy Now", which is carefully www.xmyoume.compiled and edited by XM Forex editor. I hope it will be helpful for your trading! Thank you for your support!

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here

CATEGORIES

News

- 【XM Market Analysis】--EUR/USD Forex Signal: On the Cusp of a Breakdown

- 【XM Market Analysis】--Gold Forecast: Faces Resistance at $2,900

- 【XM Market Review】--USD/CHF Forecast: US Dollar Continues to Chop Against Swiss

- 【XM Forex】--USD/PHP Forecast: US Dollar Powers Higher Against Philippine Peso

- 【XM Forex】--Silver Forecast: Silver Continues to Find Buyers on Dips