Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

market analysis

【XM Decision Analysis】--The Best AI Stocks to Buy Now

Risk Warning:

The purpose of information release is to warn investors of risks and does not constitute any investment advice. The relevant data and information are from third parties and are for reference only. Investors are requested to verify before use and assume all risks.

Hello everyone, today XM Forex will bring you "【XM Decision Analysis】--The Best AI Stocks to Buy Now". I hope it will be helpful to you! The original content is as follows:

Why Should You Consider Buying AI Stocks?

AI stocks will disrupt every sector of life, and the cycle remains in its infancy. Therefore, a gigantic growth cycle awaits AI stocks. There are many ways investors can attempt to ride the AI wave higher. AI stocks also represent innovation, improving efficiencies, enabling www.xmyoume.companies to lower costs, and investor enthusiasm.

Here are a few ways to invest in AI stocks:

- Invest is AI stocks that build the semiconductors and GPUs necessary to run AI-based solutions.

- Invest in AI stocks that train AI models.

- Invest in AI stocks that build data centers.

- Invest in AI stocks that develop AI tools.

- Invest in AI stocks that manufacture the hardware for AI solutions to function.

What Are the Downsides to AI Stocks?

While AI stocks benefit from bullish catalysts, investors should consider short-term downside risks before adding AI stocks to their portfolios.

Here are two core downside risks to AI stocks:

- Most AI stocks are excessively overvalued and expensive.

- The good news is mostly priced into the current share price.

Here is a shortlist of meme stocks that have made waves or are currently trending:

- NVIDIA (RIVN)

- Advanced Micro Devices (AMD)

- Dell Technologies (DELL)

- Taiwan Semiconductor Manufacturing (TSM)

- Digital Realty (DLR)

- Microsoft (MSFT)

- Meta Platforms (META)

- Amazon (AMZN)

- Alphabet (GOOG)

- Baidu (BIDU)

- Alibaba (BABA)

- ASML (ASML)

- Innodata (INOD)

- Quantum www.xmyoume.computing (QUBT)

- TSS (TSSI)

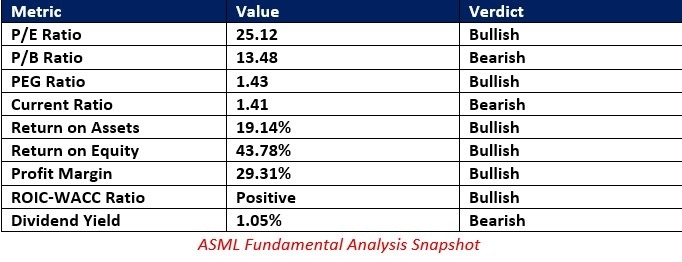

ASML Fundamental Analysis

ASML (ASML) has a monopoly on extreme ultraviolet lithography (EUVL) photolithography machines. They are necessary to manufacture the world’s most advanced chips. It is also a NASDAQ 100 and Euro STOXX 50 constituent.

So, why am I bullish on ASML after its recent correction?

ASML is a core player in the AI race, as it is the sole manufacturer of EUVLs. Therefore, the success of most Western AI stocks leads back to a machine manufactured by ASML.

The price-to-earnings (P/E) ratio of 11.73 makes ASML an inexpensive stock. By www.xmyoume.comparison, the P/E ratio for the NASDAQ 100 is 41.42.

The average analyst price target for ASML is 850.67. It suggests excellent upside potential from current levels.

ASML Technical Analysis

ASML Price Chart

- The ASML D1 chart shows price action between its ascending 50.0% and 61.8% Fibonacci Retracement Fan.

- It also shows ASML trading inside of a horizontal resistance zone.

- The Bull Bear Power Indicator turned bearish but stabilized at its ascending support level.

My Call

I am taking a long position in ASML between 701.19 and 730.60. The valuation of ASML ranks among the cheaper ones in the AI sector, and there will be no AI without the machines ASML sells.

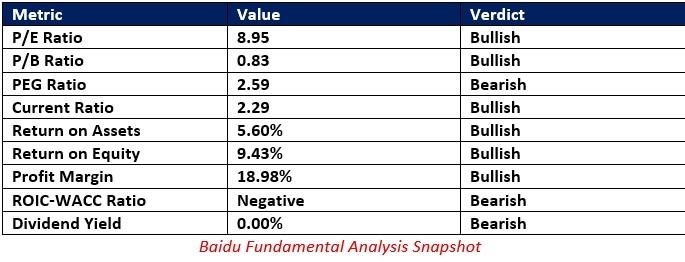

Baidu Fundamental Analysis

Baidu (BIDU) is a Chinese multi-national technology conglomerate with an expanding AI footprint and a leadership in internet search.

So, why am I bullish on BIDU after its most recent advance?

BIDU considers going open source in its AI business, which could catapult this undervalued www.xmyoume.company ahead of many www.xmyoume.competitors. It is also well-persified with a steady income stream from search that allows it to finance its ambitious AI plans.

The price-to-earning (P/E) ratio of 8.95 makes BIDU an inexpensive stock. By www.xmyoume.comparison, the P/E ratio for the NASDAQ 100 is 41.42.

The average analyst price target for BIDU is 101.07. It suggests more upside potential for this sleeping dragon.

Baidu Technical Analysis

- The BIDU D1 chart shows price action supported by its ascending Fibonacci Retracement Fan.

- It also shows BIDU trending higher inside a bullish price channel.

- The Bull Bear Power Indicator is bullish, and the trendline has moved higher since April.

My Call

I am taking a long position in BIDU between 85.17 and 94.50. BIDU benefits from low valuations, a healthy balance sheet, and a well-persified business model with search and AI at its core.

Taiwan Semiconductor Manufacturing Fundamental Analysis

Taiwan Semiconductor Manufacturing (TSM) is a Taiwanese semiconductor contract manufacturing and design www.xmyoume.company. It is also the world’s largest dedicated independent semiconductor foundry.

So, why am I bullish on TSM despite its almost 100% rally from the April lows?

TSM is a leading semiconductor www.xmyoume.company for the most advanced chips. It counts AMD, NVIDIA, Qualcomm, HiSilicon, Spectra7, ARM, and Apple among its customers. I expect its dominance in contract manufacturing to continue amid the ongoing AI cycle.

The price-to-earning (P/E) ratio of 28.80 makes TSM an inexpensive stock. By www.xmyoume.comparison, the P/E ratio for the NASDAQ 100 is 41.42.

The average analyst price target for TSM is 269.76. It suggests moderate upside potential, but investors should not ignore potential increases to the price target.

Taiwan Semiconductor Manufacturing Technical Analysis

- The TSM D1 chart shows price action hugging its 0.00% ascending Fibonacci Retracement Fan.

- It also shows TSM trending higher inside a bullish price channel.

- The Bull Bear Power Indicator is bullish, and except for one session, has remained in bullish territory since the end of April.

My Call

I am taking a long position in TSM between 231.76 and 248.28. TSM assists several leading AI stocks, and it should continue its upward momentum. I will buy the dip in this semiconductor foundry.

The above content is all about "【XM Decision Analysis】--The Best AI Stocks to Buy Now", which is carefully www.xmyoume.compiled and edited by XM Forex editor. I hope it will be helpful for your trading! Thank you for your support!

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here

CATEGORIES

News

- 【XM Group】--Dow Jones Forex Signal: Eyes Breakout

- 【XM Market Analysis】--USD/PHP Forex Signal: Philippine Peso Challenges Dollar in

- 【XM Market Analysis】--USD/CAD Forecast :US Dollar All Over the Place Against the

- 【XM Group】--EUR/USD Forex Signal: Euro Hurt By Soaring US Dollar

- 【XM Decision Analysis】--GBP/USD Forecast: Eyes Breakout